For years, Washington has tried to discipline Beijing through tariffs.

It hasn’t worked well enough.

The reason is simple: the U.S. is using linear punishment against a regime that operates through compound extraction.

The People’s Republic of China(PRC)’s customs system already shows us how power really taxes. The question is whether the United States is willing to learn from it.

1. Why China’s trade system is far more aggressive than it looks

Most people think China charges importers a “tariff.”

It doesn’t.

It charges a stack of taxes, multiplied together.

A typical imported good into China faces three layers:

Customs duty

Import consumption tax

Import VAT

Crucially, VAT is calculated not on the price of the good — but on the price plus all the previous taxes.

That means China uses tax-on-tax.

A 20% tariff followed by a 20% consumption tax and a 13% VAT does not produce 53%.

It produces almost 70%: (1+20%)×[1+20%/(1-20%)]×(1+13%)-1=69.5%

That is not additive taxation.

That is compounding extraction.

This is how the PRC turns its border into a revenue machine.

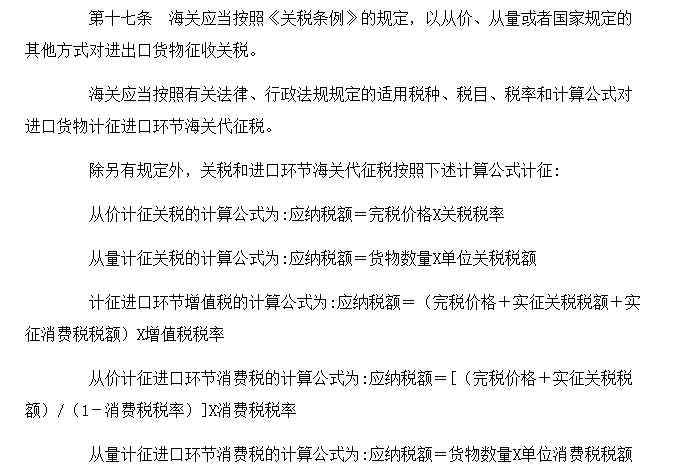

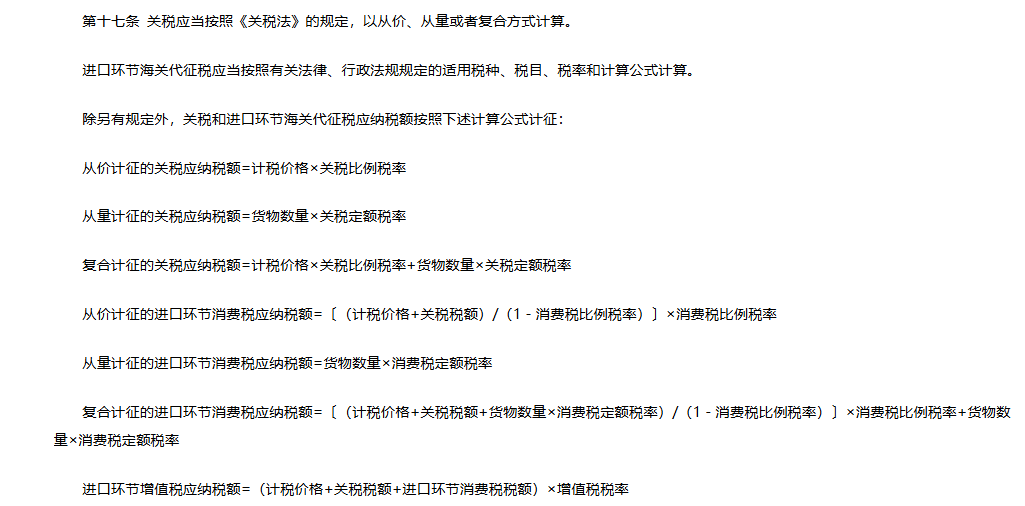

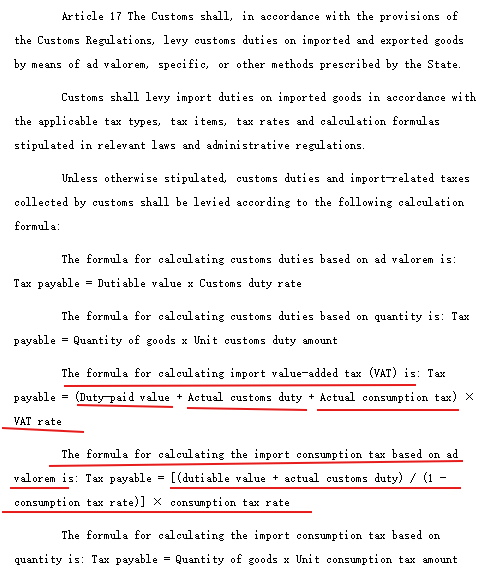

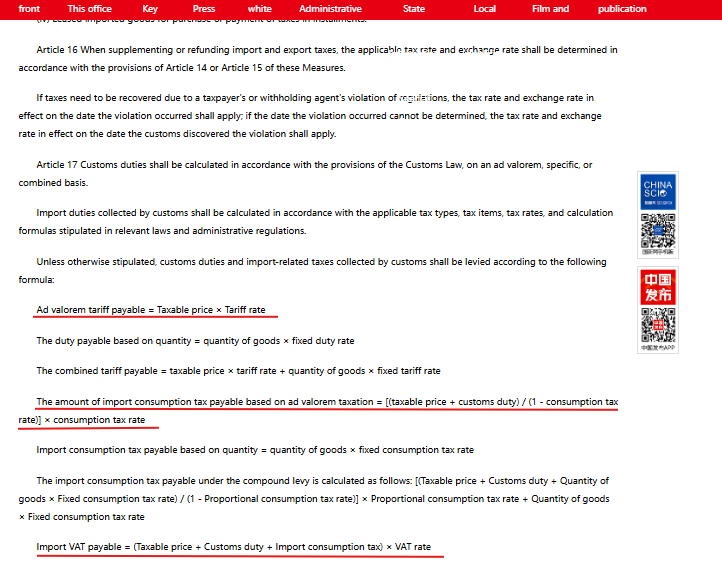

This is Article 17 of the People’s Republic of China Customs Import/Export Tax Management Measures (2024). The “Administrative Measures for the Collection of Customs Duties on Import and Export Goods of the People’s Republic of China” has been in effect since at least 2005, with its core provisions largely unchanged. While the Chinese Customs issued a new version on October 28, 2024 (to take effect on December 1, 2024), this is essentially a reaffirmation of long-standing rules rather than a new policy.

Because this regulation has been quietly enforced for nearly two decades, it has largely gone unnoticed by mainstream U.S. media and policymakers. As a result, U.S. government agencies and Congress have rarely addressed or complained about the ways in which Chinese customs applies consumption taxes, even though these rules directly affect American companies operating in China.

It shows the compounding calculation of tariffs, excise, and VAT, which significantly increases effective import taxation

.

2. The fatal flaw in U.S. tariff policy

The United States does the opposite.

Washington keeps announcing:

• 10% tariff

• then another 15%

• then another 20%

These are additive.

So even when the headlines say “massive tariffs,” the economic effect is often modest — especially for a regime willing to subsidize exporters.

China absorbs pain far better than democracies do.

Linear penalties don’t deter authoritarian systems.

3. The alternative: Compounding Tariffs

What the U.S. should adopt instead is what Beijing already uses:

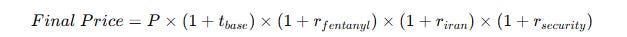

A multiplicative tariff model based on sovereign risk.

Instead of one tariff, the U.S. should apply layers, each tied to a separate legal violation:

• Base tariff (WTO / MFN)

• Fentanyl trafficking

• Iran sanctions evasion

• Military and technology threats

• Human rights violations

Each becomes a multiplier, not an addition.

Mathematically:

Example:

Base tariff: 10%

Fentanyl penalty: 25%

Iran trade penalty: 25%

That gives:

1.10×1.25×1.25=1.72

That is a 72% effective tariff, without raising any single number above what is politically defensible.

This is exactly how China taxes imports.

4. Why this is legally clean

Each multiplier can be anchored to existing U.S. law:

These are not one sanction.

They are stacked compliance failures.

Multiplying them reflects reality:

China is not committing one violation — it is committing many.

5. Why this terrifies Beijing

Because this model is:

• Automatic

• Transparent

• Hard to negotiate away

• Easy to reverse — if behavior changes

If China stops exporting fentanyl precursors, one multiplier drops.

If it stops dealing with Iran, another drops.

This makes the tariff system behavior-linked, not politics-linked.

And it does something devastating:

It forces global supply chains to move.

A Chinese product might face 1.7× or 2.2× pricing

while Vietnam, Mexico, or India faces 1.1×.

No embargo required.

No blacklist required.

Just math.

6. This is not protectionism — it is risk pricing

Financial markets already price sovereign risk this way.

Bad actors pay higher interest.

Trade should do the same.

China’s current model externalizes the costs of:

• narcotics

• sanctions evasion

• military threats

• human rights abuses

A compounding tariff internalizes them.

7. Beijing already taught us this weapon

China uses compounding taxes to extract wealth.

The United States should use compounding tariffs to enforce order.

Same math.

Different values.

And this time, the leverage will actually work.

8. This is not theoretical — Congress can verify it tomorrow

Everything described above is not a model.

It is already happening.

Any U.S. legislator, committee staffer, or investigative journalist can verify it using one simple source:

The import tax filings of U.S. companies operating in China.

Every American multinational that imports components, equipment, or finished goods into the PRC must file:

• Customs valuation declarations

• Tariff calculations

• Import VAT and (Where applicable)consumption tax forms

These documents show:

CIF price

Customs duty

(Where applicable)Consumption tax

Import VAT

And how each tax is applied on top of the previous one

Pick any U.S. firm with a Chinese subsidiary —

a pharmaceutical company, a medical device maker, an automaker, a semiconductor fab —

and request a single quarter of their Chinese import tax filings.

What you will see is not additive taxation.

You will see multiplicative extraction.

PCAOB inspections are sample-based and risk-focused; they do not, and cannot, audit every line item for every auditor in every inspection. That is precisely the point: the evidence already exists in U.S. regulatory channels, and the sampling universe gives investigators a predictable entry point.

Audit work papers for U.S.-listed companies with China operations routinely contain line-by-line import tax schedules (declared customs value, tariff assessed, VAT and any excise where applicable). PCAOB inspections — and the firms’ internal and external tax workpapers that feed those inspections — therefore provide a forensic trail. Even if a single PCAOB inspection did not review a company’s full customs schedule, the combination of: (a) sampled PCAOB files, (b) Big Four tax workpapers, and (c) targeted document requests to the companies themselves creates a reconstructable record.

In practice, that means Congress, enforcement agencies, or investigative journalists do not need a “perfect” single audit file showing every instance. They need a programmatic approach: identify representative sampled files, triangulate with the firms’ customary tax schedules, and use targeted legal compulsion where voluntary cooperation is insufficient. Once the math is shown in a handful of representative engagements, the inference is both straightforward and politically potent.

China already treats U.S. companies as if they are subject to a compounding sovereign-risk tariff.

The only difference is that Washington refuses to do the same in return.#Democracy #Christ #Peace #Freedom #Liberty #Humanrights #人权 #法治 #宪政 #独立审计 #司法独立 #联邦制 #独立自治