(picture source: gov.cn)

On 4 February 2022 Russian President Vladimir Putin visited China and attended the opening ceremony of the Beijing Winter Olympics. President Xi Jinping held a meeting with Putin. During the visit, relevant departments and enterprises of both sides signed the following cooperation documents:

1. "Agreement on Cooperation between the Government of the People's Republic of China and the Government of the Russian Federation in the Field of Anti-monopoly Law Enforcement and Competition Policy"

2. "2022 Consultation Plan between the Ministry of Foreign Affairs of the People's Republic of China and the Ministry of Foreign Affairs of the Russian Federation"

3. "Joint Statement of the Ministry of Commerce of the People's Republic of China and the Ministry of Economic Development of the Russian Federation on Completing the Development of the Roadmap for the High-quality Development of Sino-Russian Trade in Goods and Services"

4. "Memorandum of Understanding between the Ministry of Commerce of the People's Republic of China and the Ministry of Economic Development of the Russian Federation on Promoting Investment Cooperation in the Field of Sustainable (Green) Development"

5. "Arrangement of the General Administration of Customs of the People's Republic of China and the Russian Federal Customs Service on the Mutual Recognition of "Certified Operators""

6. "The General Administration of Customs of the People's Republic of China and the Russian Federation Consumer Rights Protection and Public Welfare Supervision Bureau Frontier Health and Quarantine Cooperation Agreement"

7. "Supplementary Clauses to the Protocol of the General Administration of Customs of the People's Republic of China and the Ministry of Agriculture of the Russian Federation on the Phytosanitary Requirements for Wheat Exported to China from Russia"

8. Supplementary Articles to the Protocol of the General Administration of Customs of the People's Republic of China and the Russian Federal Veterinary and Phytosanitary Supervision Service on the Phytosanitary Requirements for Barley Exported to China from Russia

9. "Protocol of the General Administration of Customs of the People's Republic of China and the Russian Federal Veterinary and Phytosanitary Supervision Service on Inspection and Quarantine Requirements for Russian Alfalfa Grass to China"

10. "Joint Statement of the General Administration of Sports of the People's Republic of China and the Ministry of Sports of the Russian Federation on the Holding of the China-Russia Sports Exchange Year 2022-2023"

11. "Cooperation Agreement between China Satellite Navigation System Committee (People's Republic of China) and Roscosmos (Russian Federation) on Time Interoperability of BeiDou and GLONASS Global Navigation Satellite Systems"

12. "CNPC and Gazprom Far East Natural Gas Purchase and Sale Agreement"

13. Supplementary Agreement 3 to "The Crude Oil Purchase and Sale Contract to Guarantee Oil Supply to Refinery in Western China"

14. Memorandum of Understanding on Cooperation in the Field of Low-Carbon Development between China National Petroleum Corporation and Rosneft

15. Cooperation Agreement in the Field of Informatization and Digitalization.

All men are endowed by their Creator with unalienable Right of Liberty. Welcome to follow @CPAJim2021 on X or Twitter,a platform seriously restricted in China. https://twitter.com/CPAJim2021

China and Russia sign a series of cooperation documents to start global aggression action

Ukrainians fighting Russia are friends of China

#Russia is an old enemy of #China#

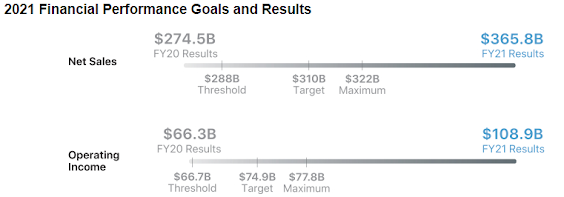

Apple's extremely controversial 2021 annual report indicates Apple is acting as agent of Xi Jinping regime

Apple knowingly failed to disclose segment information of Mainland China separately

When Apple disclosed segment information in its annual report, it disclosed Greater China or China segment' s information where Greater China or China include Mainland China, Taiwan and Hong Kong, inspite of knowing Taiwan being distinct from Mainland China and Hong Kong in terms of property of risks.

On page 7 of annual report, it disclosed

tensions between the U.S. and China have led to a series of tariffs being imposed by the U.S. on imports from China mainland

Here China doesn't include Taiwan. There's no such tentions between Taiwan and US.

Explanation of reasons of sales growth from China is misleading

On page 20, it claimed that Greater China net sales increased 70% during 2021 compared to 2020 due to higher net sales of iPhone, iPad and Services and the strength of the Chinese renminbi relative to the U.S. dollar.

The statement, making financial statements users falsely think that Chinese renminbi was used in all the Greater China regions,is in conflict with the fact that Taiwan dollar, Hong Kong dollar and Chinese renminbi are used in Taiwan, Hong Kong and Mainland China respectively.

The statement, making financial statements users falsely think that the reliability of revenue number of Greater China is same among Mainland China, Taiwan and Hong Kong and is the same as that of Americas, Europe, Japan and rest of the world, is in conflict with the fact that referred work related to the China mainland-based operations of non-Chinese public companies whose principal, signing auditor is outside of China, has been unavailable to inspection carried out by Public Company Accounting Oversight Board of the United States of America because of obstruction of Xi Jinping regime.

Total net sales in 2021 rose by $91.3 billion while Greater China increased $28.06 billion, which is 30.73% of total net sales increase. Compensation relied on satisfying net sales target of $310 billion. Net sales in 2021 exceeded the target by $55.8 billion. Net sales also influenced operating income target as net sales minus cost of sales minus operating expenses as indicated by Apple's CONSOLIDATED STATEMENTS OF OPERATIONS.

In consequence, the performance measurement of Mainland China of Apple is possibly biased and is likely to result in false promotion and compensation decisions.

Misleading statement regarding forced labour in China

It was stated in proxy statement that in 2020 Apple and its independent third-party auditors conducted 1,121 assessments of suppliers around the world. ... to argue that it has performed sufficient work on preventing forced labour. But the statement didn't mention how many audits have been performed in China regarding concerns of stakeholders. Apple didn't even disclose what percentage Apple sourced materials or labour from Mainland China.

Referred audit work related to the China mainland-based operations of Apple, unavailabe to US PCAOB's inspection, also included understanding and testing of internal control in Mainland China, in addition to substantive procedures. Robust internal control is necessary to implement sound anti-forced labour policies. Apple's financial reporting practices of messing China with Taiwan make it difficult to report separately to what extent Apple relied on forced labour Made in China. It's very rare to see media reporting forced labour in Taiwan.

Misleading statement regarding censorship in China

Apple provided that it has adopted various policies to protect human rights. But the effect of every policy relied on internal control's effectiveness and efficiency as well as overall environment. Apple failed to answer specifically how effective the policy and internal control in China was and failed to emphasize its policy may not always be in effect.

Apple has been proactively helping Xi Jinping regime to censor Chinese by buiding Data center in Ulanqab, Inner Mongolia whose construction work was begun on 15 March 2019 and completed in 2020. The construction work was completed by China State Construction Engineering Corporation,a Chinese military PLA entity. PLA is directed by Xi Jinping.

Apple is acting as agent of Xi Jinping regime

Xi Jinping regime censored Chinese speech and made force labour to happen to benefit Apple(苹果)'s management in China. Xi Jinping regime banned PCAOB's inspection of referred work to help Apple manipulate revenue numbers and cover up corruption possibly included in the audit papers. The words of proxy statement is more like propaganda and diplomatic words of Xi Jinping regime, unresponsive to concerns.

There is one subsidiary in China,Apple Computer Trading (Shanghai) Co., Ltd. which is subject to coercion. Xi Jinping regime has coerced many multinational companies with China business in the past for Xi Jinping's benefit, such as in the issues of Taiwan, Lithuania, Xinjiang genocide,etc.

Apple and its management should be required to be registered as foreign agent with US Department of Justice before Apple cuts off all the business relations with Mainland China.

There are material misstatements regarding Ford's China business in the financial statements as of 31 Dec 2021

The Automotive segment primarily includes the sale of Ford and Lincoln vehicles, service parts, and accessories worldwide, together with the associated costs to develop, manufacture, distribute, and service the vehicles, parts, and accessories. This segment includes revenues and costs related to our electrification vehicle programs. The segment includes the following regional business units: North America, South America, Europe, China (including Taiwan), and the International Markets Group.

The U.S. administration has sought to address this issue with currency provisions that were included in the United States-Mexico-Canada Agreement and United States-China trade deals.

China includes Taiwan; China market share includes Ford brand and JMC brand vehicles produced and sold by our unconsolidated affiliates.

For example, the China Stage VI light duty vehicle emission standards, based on European Stage VI emission standards for light duty vehicles, U.S. evaporative and refueling emissions standards, and CARB OBD II requirements, incorporate two levels of stringency for tailpipe emissions. Under the level one (VI(a)) standard, which is currently in place nationwide in China, the emissions limits are comparable to the EU Stage VI limits, except for CO, which is 30% lower than the EU Stage VI limit. The more stringent level two (VI(b)) standard’s emissions limits are approximately 30-50% lower than the EU Stage VI limits, depending on the pollutant. While level two (VI(b)) is not slated for nationwide implementation until July 2023, the government has encouraged the more economically developed cities and provinces to pull ahead implementation. For example, Shanghai, Tianjin, Hebei province, and Guangdong province have all begun implementing level two (VI(b)). Both China Stage VII light duty vehicle and heavy duty vehicle emission regulations are currently under evaluation, and the Ministry of Ecology and Environment has advised that the Stage VII regulations will have more stringent limits on pollutant emissions and will establish limits for greenhouse gas (primarily CO2) tailpipe emissions.

China’s Corporate Average Fuel Consumption and New Energy Vehicle (“NEV”) Credit Administrative Rules contain fuel consumption requirements as well as credit mandates for NEV passenger vehicles, i.e., plug-in hybrids, battery electric vehicles, or fuel cell vehicles. The fuel consumption requirement uses a weight-based approach to establish targets, with year-over-year target reductions. China set a target of 5.0L/100km for the 2020 passenger vehicle industry fuel consumption fleet average, which lowers to 4.0L/100km by 2025 based on the New European Driving Cycle (“NEDC”) system. The government is projecting a further fuel consumption reduction in 2030 and is targeting 3.2L/100km. The NEV mandate requires that OEMs generate a specific amount of NEV credits each year, with NEV credits of at least 14%, 16%, and 18% of the annual ICE passenger vehicle production or import volume required in 2021, 2022, and 2023, respectively. Future percentages are currently under consideration.

Safety and recall requirements in Brazil, China, India, and Gulf Cooperation Council (“GCC”) countries may add substantial costs and complexity to our global recall practice. Brazil has set mandatory fleet safety targets, and penalties are applied, if these levels are not maintained, while a tax reduction may be available for over-performance. In Canada, regulatory requirements are currently aligned with U.S. regulations; however, under the Canadian Motor Vehicle Safety Act, the Minister of Transport has broad powers to order manufacturers to submit a notice of defect or non-compliance when the Minister considers it to be in the interest of safety. In 2021, Canada started preliminary consultations on several new proposed regulations, including an Administrative Monetary Penalties (“AMPs”) Regulation. Draft language for the AMPs regulation is expected in 2022. In China, a new mandatory Event Data Recorder regulation that is more comprehensive than U.S. requirements has been released, and in China, Malaysia, and South Korea, mandatory e-Call requirements are being drafted. E-Call is mandatory in the UAE for new vehicles beginning with the 2021 model year, and is expected to become mandatory in a number of other GCC countries within five years.

New Car Assessment Programs. Organizations around the world rate and compare motor vehicles in NCAPs to provide consumers and businesses with additional information about the safety of new vehicles. NCAPs use crash tests and other evaluations that are different than what is required by applicable regulations, and use stars to rate vehicle safety, with five stars awarded for the highest rating and one for the lowest. Achieving high NCAP ratings, which may vary by country or region, can add complexity and cost to vehicles. Similarly, environmental rating systems exist in various regions, e.g., Green NCAP in Europe. In China, C-NCAP has a stringent rating structure to decrease the number of five-star ratings. Further, the China Insurance Auto Safety Index (similar to IIHS) has been implemented, with higher standards for passenger and pedestrian protection and driver assistance technologies. These protocols impose additional requirements relating to testing, evaluation, and mandatory safety features, and compliance with them (or any subsequent updates to them) may be costly.

China presents unique risks to U.S. automakers due to the strain in U.S.-China relations and China’s unique regulatory landscape.

If industry vehicle sales were to decline to levels significantly below our planning assumption for key markets including the United States, Europe, or China, the decline could have a substantial adverse effect on our financial condition, results of operations, and cash flow.

Changan Ford Automobile Corporation, Ltd. (“CAF”) — a 50/50 joint venture between Ford and Chongqing Changan Automobile Co., Ltd. (“Changan”). CAF operates four assembly plants, an engine plant, and a transmission plant in China where it produces and distributes a variety of Ford passenger vehicle models.

— a publicly-traded company in China with Ford (32% shareholder) and Nanchang Jiangling Investment Co., Ltd. (41% shareholder) as its controlling shareholders. Nanchang Jiangling Investment Co., Ltd. is a 50/50 joint venture between Changan and Jiangling Motors Company Group. The public investors in JMC own 27% of its total outstanding shares. JMC assembles Ford Transit, a series of Ford SUVs, Ford engines, and non-Ford vehicles and engines for distribution in China and in other export markets. JMC operates two assembly plants and one engine plant in Nanchang.

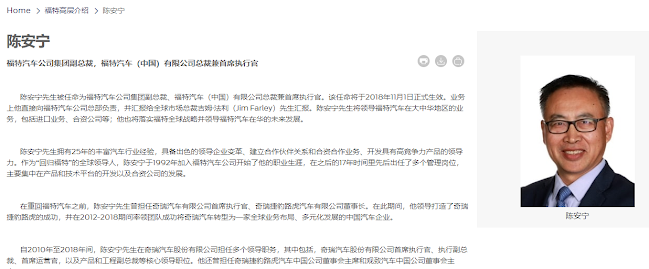

Anning Chen President and Chief Executive Officer, Ford of China December 2018 Age 60

Prior to becoming Vice Chair, Policy, Governor Huntsman was re-elected a member of Ford’s Board of Directors in October 2020 after previously serving as a director from 2012 to 2017. Governor Huntsman served as the U.S. Ambassador to Russia from 2017 through 2019. He served as the Chairman of the Atlantic Council of the United States from 2014 until 2017 and Chairman of the Huntsman Cancer Foundation from 2012 until 2017. He has previously served as U.S. ambassador to China, U.S. ambassador to Singapore, and as Deputy U.S. Trade Representative. Governor Huntsman was twice elected Governor of Utah.

Prior to becoming President and Chief Executive Officer, Ford of China, from 2010 to 2018, Anning Chen held several leadership roles in Chery Automobile LTD, China including: Chief Executive Officer; Executive Vice President and Chief Operating Officer; and Vice President of Products and Engineering. He also held the positions of Chairman of the Board of Directors, Chery Jaguar Land Rover Automotive, China; and Chairman of the Board, Qoros Automotive, China.

Consistent with the actions taken by governmental authorities, in late March 2020, we idled our manufacturing operations in regions around the world other than China, where manufacturing operations were suspended in January and February before beginning to resume operations in March.

In Asia, however, excess capacity declined from 19.3 million units in 2019 to 15.9 million in 2020 and to 15.2 million units in 2021, coming off a weak base for China’s economy and automotive sector during 2018 and 2019.

China (Including Taiwan)

In China, 2021 wholesales increased 5% from a year ago, driven by higher joint venture volumes. Full year 2021 consolidated revenue declined 20%, driven by product localization and the de-consolidation of our operations in Taiwan, partially offset by favorable import mix, higher component sales to our joint ventures in China, and stronger currencies.

Wholesales and Revenue – wholesale unit volumes include all Ford and Lincoln badged units (whether produced by Ford or by an unconsolidated affiliate) that are sold to dealerships, units manufactured by Ford that are sold to other manufacturers, units distributed by Ford for other manufacturers, and local brand units produced by our China joint venture, Jiangling Motors Corporation, Ltd. (“JMC”), that are sold to dealerships. Vehicles sold to daily rental car companies that are subject to a guaranteed repurchase option (i.e., rental repurchase), as well as other sales of finished vehicles for which the recognition of revenue is deferred (e.g., consignments), also are included in wholesale unit volumes. Revenue from certain vehicles in wholesale unit volumes (specifically, Ford badged vehicles produced and distributed by our unconsolidated affiliates, as well as JMC brand vehicles) are not included in our revenue.

In 2020, wholesales in our Automotive segment declined 22% from 2019, reflecting a decrease in each business unit other than China.

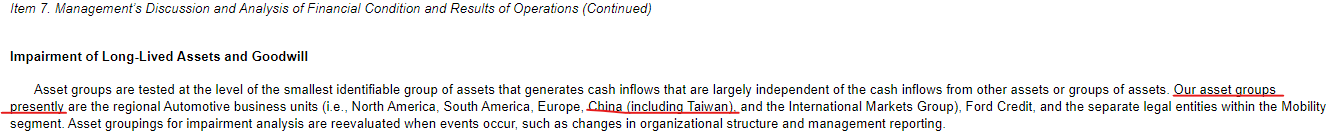

Asset groups are tested at the level of the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. Our asset groups presently are the regional Automotive business units (i.e., North America, South America, Europe, China (including Taiwan), and the International Markets Group), Ford Credit, and the separate legal entities within the Mobility segment.

Examinations by tax authorities have been completed through the following years: 2004 in India, 2006 in Mexico, 2008 in Germany, 2010 in Spain, 2011 in Canada, 2014 in the United States and the United Kingdom, and 2016 in China.

On March 1, 2021, we acquired Magna’s shares in the restructured GFT. The purchase price, which is subject to post-closing revisions, presently is estimated at $273 million. We expect that the purchase price revisions will be finalized by the first quarter of 2022. The restructured GFT includes the Halewood, UK and Cologne, Germany transmission plants, but excludes the Bordeaux, France transmission plant and China interests acquired by Magna.

There are likely material misstatements in the annual report, such as follows,

1.It is wrong to include Taiwan in China. It is also wrong to make management decisions based on this. The nature of risks in Taiwan is completely different from that in China.

2.Segment information puts China in the All other section, concealing risk exposure to China from investors.

3.It is also inappropriate for Ford to put its businesses in China and Taiwan in one asset group for impairment testing, and it is very likely that Ford’s accrual amount for asset impairment losses in 2019-2021 or even previous years is wrong. China Mainland lacks rule of law that prohibites environment pollution that could influence measurement of recoverable value.

4. In addition, the PCAOB of the United States was unable to check the audit papers of the accountants related to Ford's business in mainland China. The risk of fraud by Ford management in mainland China is high.

To be cautious about Ford's lobbying activities for China that may harm American state security, it's necessary to require Ford's management to be registered as foreign agent with Department of Justice before moving all businesses out of China.

GE's management is likely to become an agent of Xi Jinping regime

GE has 7 subsidiaries in China: GE Healthcare (China) Co., Ltd, GE Healthcare (Shanghai) Co Ltd, GE Hydro China Co., Ltd, GE Medical Systems Trade and Development (Shanghai) Co., Ltd, etc., which are involved in the CCP's medical, aviation, energy and other industries.

There's Great Firewall in China that prevents corruption being exposed.

GE and the CCP’s virus economy are tied together.

GE Healthcare China's digital healthcare strategy is based on the Edison digital healthcare intelligence platform, combining hospital intelligent management (APM, RCC Radiology Command Center, Mural Intensive Care Command Center), cloud computing (cloud ECG, cloud imaging) and artificial intelligence (Full-process artificial intelligence magnetic resonance technology platform, coronary medical image processing AI analysis system, COVID19 AI analysis platform LK2.0).

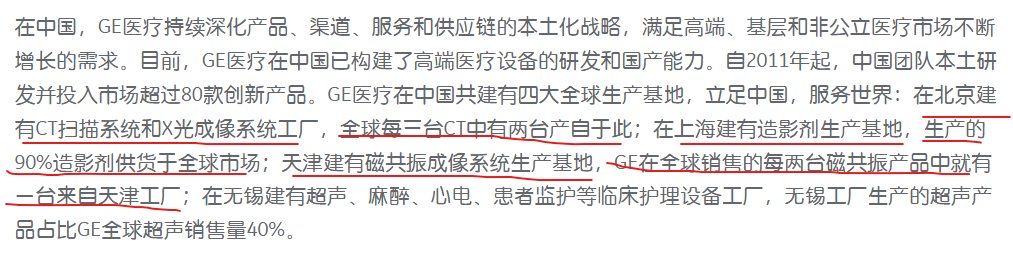

GE Healthcare has a CT scanning system and X-ray imaging system factory in Beijing, where two out of every three CTs in the world are produced; it has a contrast agent production base in Shanghai, and 90% of the contrast agent produced is supplied to the global market.

GE Healthcare has a production base for magnetic resonance imaging systems in Tianjin. One out of every two magnetic resonance products GE sells globally comes from the Tianjin factory; it has a factory in Wuxi for clinical care equipment such as ultrasound, anesthesia, ECG, and patient monitoring.

Ultrasound products produced by the Wuxi factory account for 40% of GE's global ultrasound sales.

GE has heavy reliance on made in China. Chinese Communist Party released viruses to benefit medial and biological giants, making GE's management more likely standing with CCP.

It's necessary to make laws to require any company or its management that transact with economies or invest in economies, where PCAOB's inspection is rejected, to register with Department of Justice as a foreign agent.

The information regarding GE's operation in China extracted from its annual report as follows:

products, services and activities are subject to a number of global regulators such as the U.S. Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), Civil Aviation Administration of China (CAAC) and other regulatory bodies.

RPO as of December 31, 2021 increased $1.7 billion (13%) from December 31, 2020 primarily due to new service contracts and renewals with large customers and from equipment on strong orders across all regions, notably in China and the U.S., as well as supply chain challenges in converting RPO to revenues.

Our operations and the execution of our business plans and strategies are subject to the effects of global economic trends, geopolitical risks and demand or supply shocks from events that could include war, a major terrorist attack, natural disasters or actual or threatened public health emergencies (such as COVID-19). They are also affected by local and regional economic environments and policies in the U.S. and other markets that we serve, including interest rates, monetary policy, inflation, economic growth, recession, commodity prices, currency volatility, currency controls or other limitations on the ability to expatriate cash, sovereign debt levels and actual or anticipated defaults on sovereign debt. For example, changes in local economic conditions or outlooks, such as lower rates of investment or economic growth in China, Europe or other key markets, affect the demand for or profitability of our products and services outside the U.S., and the impact on the Company could be significant given the extent of our activities outside the United States. Political changes and trends such as populism, protectionism, economic nationalism and sentiment toward multinational companies and resulting tariffs, export controls or other trade barriers, or changes to tax or other laws and policies, have been and may continue to be disruptive and costly to our businesses, and these can interfere with our global operating model, supply chain, production costs, customer relationships and competitive position. Further escalation of specific trade tensions, including intensified decoupling between the U.S. and China, or in global trade conflict more broadly could be harmful to global economic growth or to our business in or with China or other countries, and related decreases in confidence or investment activity in the global markets would adversely affect our business performance. We also do business in many emerging market jurisdictions where economic, political and legal risks are heightened.

We, our representatives, and the industries in which we operate are subject to continuing scrutiny by regulators, other governmental authorities and private sector entities or individuals in the U.S., the European Union, China and other jurisdictions, which have led or may, in certain circumstances, lead to enforcement actions, adverse changes to our business practices, fines and penalties, required remedial actions such as contaminated site clean-up or other environmental claims, or the assertion of private litigation claims and/or damages that could be material.

On December 1, 2021, we completed the sale of GE's share of our boiler manufacturing business in China in our Power segment. In connection with the transaction, we recorded a loss on the disposal of this business of $170 million in Other income in our Statement of Earnings (Loss). See Note 18 for further information.

Purchases and sales of business interests (a)Included a pre-tax loss of $170 million on the sale of our boiler manufacturing business in China in 2021.

Revenues are classified according to the region to which equipment and services are sold. For purposes of this analysis, the U.S. is presented separately from the remainder of the Americas.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, 2020 | Aviation | Healthcare | Renewable Energy | Power | Corporate | Total | ||||||||||||||

| U.S. | $ | $ | $ | $ | $ | $ | ||||||||||||||

| Non-U.S. | ||||||||||||||||||||

| Europe | ||||||||||||||||||||

| China region | ||||||||||||||||||||

| Asia (excluding China region) | ( | |||||||||||||||||||

| Americas | ||||||||||||||||||||

| Middle East and Africa | ||||||||||||||||||||

| Total Non-U.S. | $ | $ | $ | $ | $ | $ | ||||||||||||||

| Total geographic revenues | $ | $ | $ | $ | $ | $ | ||||||||||||||

| Non-U.S. revenues as a % of total revenues | % | % | % | % | % | |||||||||||||||

| Year ended December 31, 2019 | ||||||||||||||||||||

| U.S. | $ | $ | $ | $ | $ | $ | ||||||||||||||

| Non-U.S. | ||||||||||||||||||||

| Europe | ( | |||||||||||||||||||

| China region | ( | |||||||||||||||||||

| Asia (excluding China region) | ( | |||||||||||||||||||

| Americas | ( | |||||||||||||||||||

| Middle East and Africa | ||||||||||||||||||||

| Total Non-U.S. | $ | $ | $ | $ | $ | ( | $ | |||||||||||||

| Total geographic revenues | $ | $ | $ | $ | $ | $ | ||||||||||||||

| Non-U.S. revenues as a % of total revenues | % | % | % | % | % | |||||||||||||||