Rupert Hammond-Chambers, widely known as the President of the U.S.-Taiwan Business Council (USTBC), presents as a staunch advocate for Taiwan within U.S. political and business circles. Born in Scotland and emigrating to the United States in 1987, he earned a Bachelor of Arts from Denison University. After an early career in international business, he joined USTBC in 1994, rising to Vice President in 1998 and President in 2000.

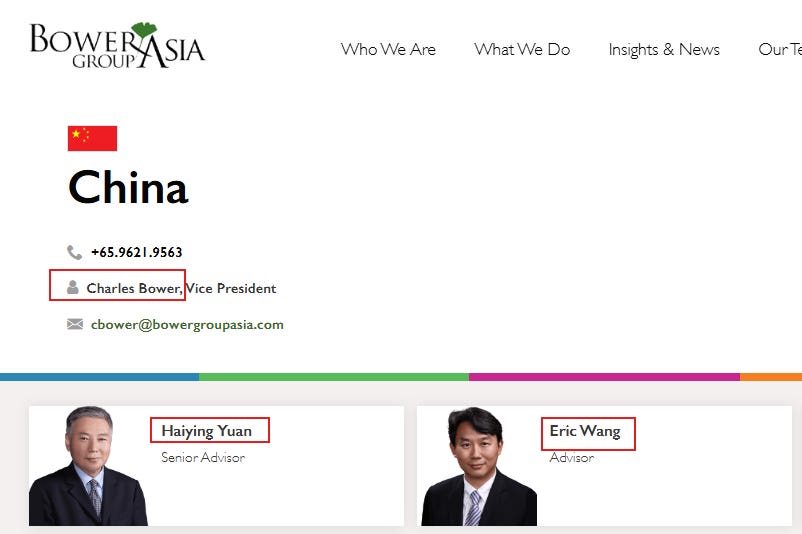

At first glance, Hammond-Chambers appears to represent American and Taiwanese interests: he promotes cross-strait economic ties, champions Taiwan’s semiconductor industry, and maintains a presence in high-level U.S. policymaking circles. He also holds senior advisory positions in Bower Group Asia (BGA), a global strategic advisory firm with extensive China-facing business.

Hammond-Chambers is also a member of the Council on Foreign Relations (CFR), a U.S. foreign policy think tank that has long been shown to contain members with deep ties to the Chinese Communist Party. Within this setting, he may coordinate or align with other CFR members who have longstanding financial and professional connections to Beijing, potentially influencing U.S. strategic decision-making on sensitive issues such as nuclear security, biosafety, and public health. Publicly visible experts in these areas have been found to advocate for CCP interests, publish in Xinhua outlets, receive funding from Chinese government agencies, and participate in the same pro-CCP organisation/forums as specialists from the Central Military Commission, the Academy of Military Sciences, and the People’s Liberation Army Navy. Hammond-Chambers’ membership in this network raises concerns that his advocacy on Taiwan and U.S.-Asia policy may be shaped, consciously or not, by these overlapping Chinese influence channels. See other articles on Huang Yanzhong and Shuxian Luo in the substack website: https://cpajim.substack.com/t/ccp-fifth-column

Bower Group Asia: China as a Core Focus

BGA’s China and Hong Kong operations are overseen by Vice President Charles Bower, placing the region at the top of BGA’s global priorities. Taiwan-focused advisory work, under Hammond-Chambers’ nominal supervision, is structurally linked to China-facing operations.

This creates a coordinated chain of influence:

BGA China leadership → CCP-connected consultants (Yuan Associates / Far & Eagle Consulting) → Taiwan advisors (Hammond-Chambers) → Client execution

Through this structure, CCP-aligned partners in China (including Hong Kong controlled by CCP since 1997) can direct operations that outwardly appear to serve U.S. or Taiwan interests, while advancing Chinese strategic goals.

Yuan Associates / Far & Eagle Consulting: Deep CCP Integration

BGA’s trusted China partner, Yuan Associates (also known as Far & Eagle Consulting), is staffed by senior consultants with decades of service in Chinese government institutions, including foreign embassies, UN agencies, and ministries. Their expertise spans government affairs, diplomacy, and corporate strategy, making them uniquely positioned to navigate both CCP and global business networks.

Taiwan-facing advisors at BGA, including Hammond-Chambers, execute requests from China-directed operations, ensuring alignment with client and CCP-linked strategic priorities. This setup allows influence to flow subtly, leveraging consulting, policy advice, and strategic communications rather than direct state channels.

Public Incidents and Strategic Implications

Evidence of Hammond-Chambers’ operational impact appears in his public actions. Notably, he has openly criticized U.S. military decisions regarding Taiwan, creating friction between the Taiwan government and U.S.-Taiwan Business Council. This aligns with CCP strategic objectives: undermining U.S.-Taiwan military cooperation, fostering internal discord, and influencing policy indirectly under the guise of business advocacy.

Additionally, his engagement in semiconductor policy, combined with public communications and advisory networks, suggests a potential channel for shaping U.S.-Taiwan economic and defense decisions—all while maintaining a credible, pro-Taiwan public persona.

A critical but overlooked aspect of Rupert Hammond-Chambers’ advocacy for TSMC as Taiwan’s “indispensable AI hardware partner” lies in the company’s actual business footprint. In a March 2025 interview, Hammond-Chambers insisted that the U.S. “must partner with Taiwan” to keep AI systems powered by American-designed chips, emphasizing TSMC’s near-monopoly on high-end semiconductors. He framed this as essential for U.S. technological leadership and Taiwan’s economic security.

Yet TSMC simultaneously serves segments of China’s military and domestic security apparatus. A portion of its revenue comes from clients such as Hikvision—already under U.S. sanctions—directly involved in surveillance and defense technologies. By publicly promoting TSMC’s strategic importance, Hammond-Chambers reinforces U.S. and Taiwanese dependence on a single company, while indirectly ensuring that parts of Taiwan’s semiconductor output benefit the Chinese Communist Party’s military and security programs. This duality exposes a stark gap between the narrative of defending Taiwan and the underlying reality of enabling Beijing’s strategic objectives.

Even from a purely professional standpoint, U.S. policy should encourage robust competition in the semiconductor sector rather than relying on a single company. Hammond-Chambers’ insistence on TSMC as an indispensable partner reflects not strategic insight but a narrow, unprofessional approach—one that amplifies systemic risk for both U.S. technology leadership and Taiwan’s economic independence. His advocacy conveniently aligns with the CCP’s interests, highlighting how a purportedly independent British advisor can distort U.S.-Taiwan strategy while presenting himself as a defender of Taiwan.

A professional in U.S.-Taiwan economic and defense strategy might benefit from revisiting foundational works on competition and strategy, such as Michael Porter’s classics. Spending less time mingling at parties with CCP-linked actors and more time analyzing market structures and competitive dynamics could prevent strategic blind spots—and reduce the risk of inadvertently advancing CCP interests under the guise of defending Taiwan.

Conclusion

Rupert Hammond-Chambers illustrates a sophisticated model of influence:

Publicly pro-Taiwan and U.S.-aligned

Operationally integrated with CCP-connected consulting partners in China

Positioned to impact U.S.-Taiwan business and military policy under a veil of professional advocacy

No comments:

Post a Comment