How a U.S.-listed professional services firm embedded itself in China’s party-state, industrial policy, and technology ecosystem — based on publicly disclosed facts.

1. Why Accenture’s China Operations Matter

Accenture plc (NYSE: ACN) presents itself to global investors as a neutral, apolitical provider of consulting, technology, and outsourcing services. Yet its own regulatory filings and publicly available disclosures tell a more complicated story about the company’s depth of integration inside the People’s Republic of China (PRC).

This article does not rely on leaks or speculation.

It is based on:

Accenture’s Form 10-K filings with the U.S. Securities and Exchange Commission

Official Chinese government and Party-affiliated publications

Publicly announced partnerships and industry events

The question is not whether Accenture operates in China — that is undisputed.

The question is how it operates, with whom, and under what political and institutional constraints.

2. What Accenture Discloses to the SEC

In its Form 10-K for the fiscal year ended August 31, 2025, Accenture lists multiple China-based subsidiaries, including but not limited to:

Accenture (China) Co., Ltd.

Accenture Enterprise Development (Shanghai) Co., Ltd.

Accenture Qiyun Technology (Hangzhou) Co., Ltd.

Accenture (Shenzhen) Technology Co., Ltd.

Accenture Technology Solutions (Dalian) Co., Ltd.

Avanade (Guangzhou) Computer Technology Development Co., Ltd.

Beijing Zhidao Future Consulting Co., Ltd.

Designaffairs Business Consulting (Shanghai) Co., Ltd.

Spark44 Limited (China)

Accenture notes that certain subsidiaries are omitted from detailed disclosure because they do not meet the SEC’s definition of a “significant subsidiary” when considered individually.

From a regulatory perspective, this framing is important:

materiality is assessed financially, not politically or strategically.

3. Corporate Presence vs. Political Embedding

Operating in China is not merely a commercial decision. Under PRC law and practice:

Private and foreign-invested enterprises are required to establish Chinese Communist Party (CCP) organizations when conditions are met.

Party organizations are explicitly tasked with “guiding direction, discussing major matters, and ensuring implementation.”

It is publicly disclosed in Chinese media that Accenture (China) has:

A Party General Branch (党总支)

Formal Party-building cooperation (党建共建) with:

Party school’s ideological educator

These activities go well beyond silent compliance. They reflect active participation in the CCP’s organizational and ideological system.

4. Senior Executives and the United Front System

One of the most consequential facts is not structural, but personal.

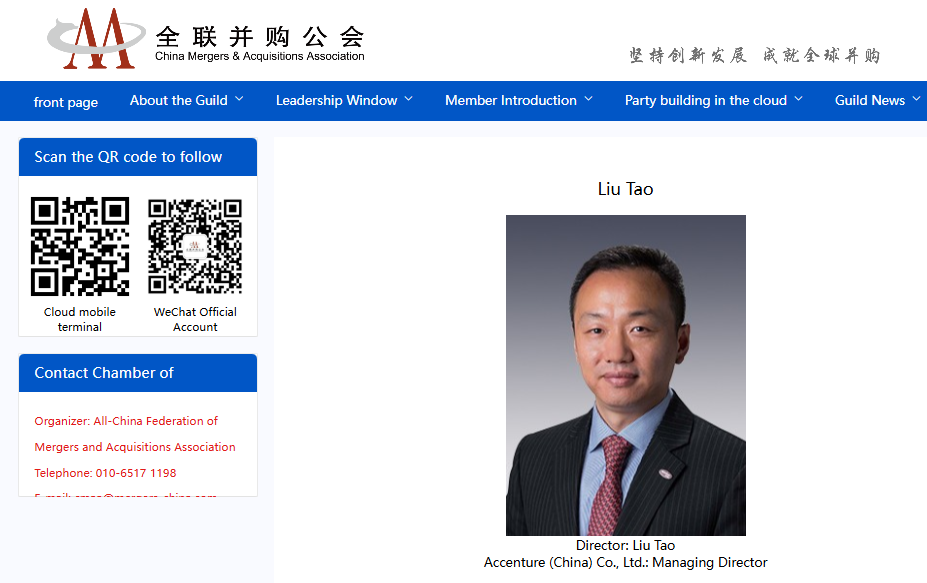

A senior executive of Accenture (China) — publicly identified in Chinese sources as Liu Tao (刘弢), Managing Director and CCP Party Branch Secretary of Accenture China — simultaneously serves as a director (理事) of the All-China Mergers & Acquisitions Association (CMAA).

According to the CMAA’s own charter:

The organization is under the supervision of the All-China Federation of Industry and Commerce

Its Party organization is subordinate to a United Front–linked Party committee

It explicitly upholds CCP leadership and ideological guidance

It implements “dual entry and cross-appointment” between Party leadership and organizational management

This is not symbolic.

The CMAA functions as a coordination platform for capital, mergers, and outbound expansion aligned with state priorities.

Additional Political Role and State Media Endorsement

Beyond corporate and industry positions, Liu Tao (刘弢) also holds a formal political role within China’s consultative governance system.

During the 2022 “Two Sessions” period, Liu Tao was publicly identified as a member of the Shanghai Huangpu District Committee of the Chinese People’s Political Consultative Conference (CPPCC). The CPPCC is not a civil society body, but a core component of the Chinese Communist Party’s United Front system, designed to co-opt elites from business, academia, and non-Party sectors into policy consultation and political alignment.

This is not a ceremonial body. It functions as a core component of the Chinese Communist Party’s United Front system, designed to co-opt elites from business, academia, and non-Party sectors into policy consultation, political alignment, and consensus-building under CCP leadership. Membership signals political trust and integration, not neutrality.

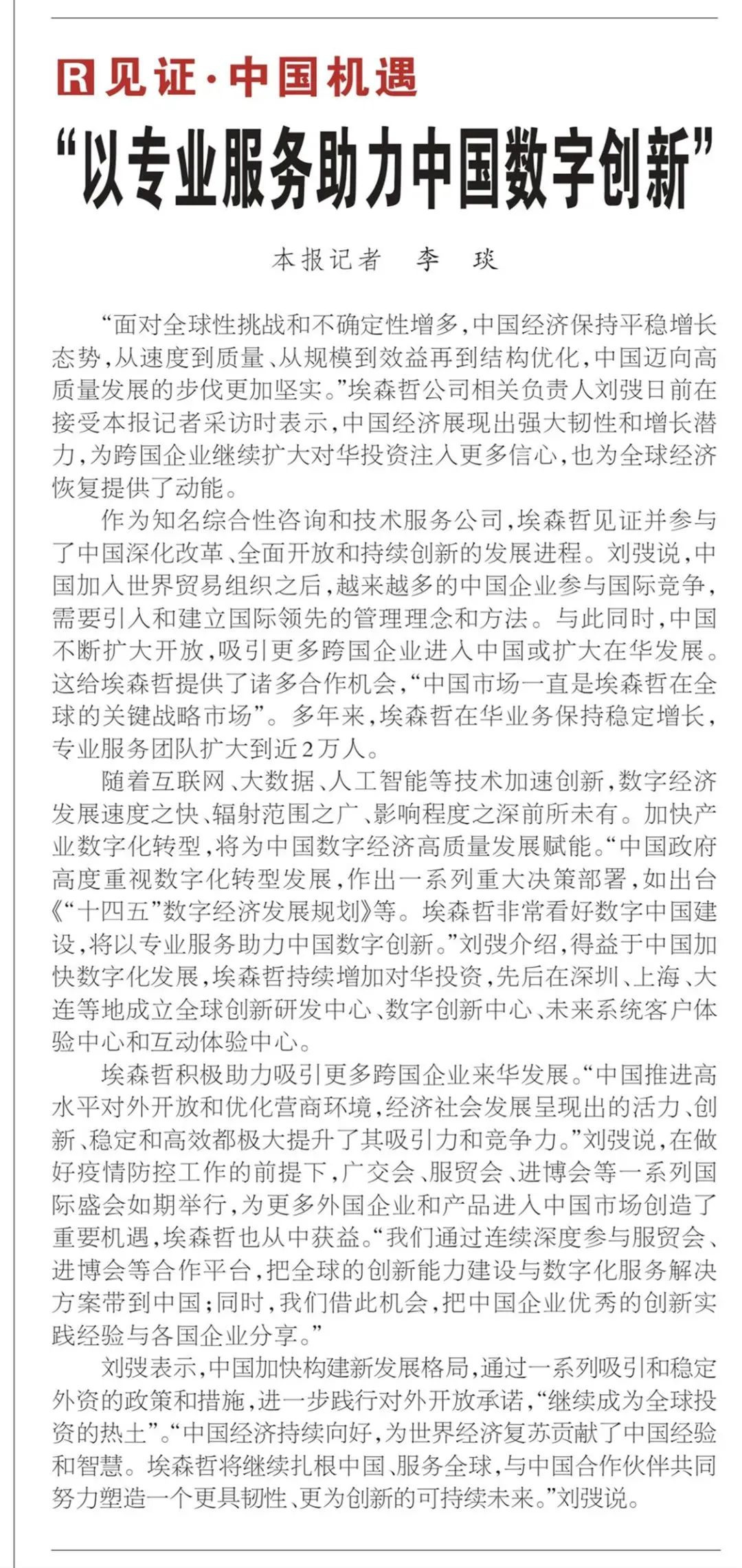

In its April 5, 2022 print edition, People’s Daily —, the official newspaper of the CCP Central Committee— portrayed Liu Tao as a representative of “foreign enterprises rooted in China,” praising Accenture’s long-term commitment to China’s digital transformation agenda. In the interview, Liu explicitly framed Accenture’s role as aligning global innovation capabilities with China’s national development priorities, emphasizing resilience, digitalization, and long-term cooperation with Chinese partners.

Such coverage is not routine commercial publicity. Appearances in People’s Daily, particularly during the Two Sessions, are a form of political endorsement, reinforcing the individual’s status as a trusted interface between multinational capital and the CCP’s economic and technological strategy.

5. Technology Partnerships in Sensitive Domains

Accenture has repeatedly and publicly partnered with Huawei, including in areas such as:

Smart cities and “smart campuses”

Autonomous and AI-driven network infrastructure

Digital twins and data-driven operational platforms

Many of these domains are classified internationally as dual-use — civilian in appearance, but applicable to:

Public security

Surveillance

Military-civil fusion ecosystems

At the same time, Accenture markets itself in the West as a trusted partner of:

Microsoft

Google

Amazon Web Services

These relationships are presented separately, yet they coexist within the same corporate structure.

Accenture–Huawei Collaboration: Timeline and Concrete Examples

Formal Strategic Alliance (2014–Present)

Accenture and Huawei publicly announced a strategic alliance in October 2014, aimed at jointly developing and promoting enterprise ICT solutions for global clients. This partnership combined:

Huawei’s telecommunications infrastructure, cloud, and hardware capabilities

Accenture’s consulting, systems integration, and managed services expertise

This alliance predated most U.S. export controls on Huawei and continued to shape downstream cooperation even after Huawei was later designated by the U.S. government.

Key point:

The relationship was not transactional or ad-hoc; it was framed as a long-term strategic partnership serving enterprise and government-adjacent clients.

Original link: https://www.prnasia.com/story/107047-1.shtml

Further detailing: https://info.chineseshipping.com.cn/cninfo/News/201709/t20170911_1294373.shtml

Joint Digital Transformation Solutions Using Huawei Cloud (2019)

In September 2019, during the Huawei Connect conference in Shanghai, Accenture and Huawei Cloud jointly released the “Intelligent Connected Digital Experience” solution.

Key elements included:

Accenture using Huawei Cloud as the underlying platform

End-to-end enterprise digital transformation services (planning, deployment, operation)

Target customers included government, logistics, manufacturing, and large enterprises

Huawei Cloud reported 500% year-on-year revenue growth in the first half of 2019, with Accenture positioned as a high-end global integrator helping Huawei reach enterprise clients that often require international consulting credentials.

Risk relevance:

This cooperation occurred after Huawei was placed on the U.S. Entity List (May 2019), raising questions about indirect value creation and ecosystem legitimization.

https://www.huaweicloud.com/news/2019/0919172933292.html

Joint White Papers and Smart Infrastructure Frameworks (2020)

In May 2020, Huawei and Accenture jointly published the “Future Smart Campus White Paper”.

Notable characteristics:

Focus on smart campuses, smart parks, and digital twins

Technologies included 5G, AI, cloud, IoT, and centralized data platforms

Contributors included Chinese universities and institutions with known defense, aerospace, or state-security linkages, such as Beihang University (BUAA)

Smart campus and smart park architectures in China frequently serve dual-use environments, including:

Industrial parks

Government compounds

State-owned enterprise clusters

Military–civil fusion zones

Risk relevance:

These architectures overlap significantly with surveillance, population management, and secure network design, areas of explicit concern to U.S. national security agencies.

https://e.huawei.com/cn/news/ebg/2020/future-smart-campus-white-paper

Telecommunications and Autonomous Network Cooperation (2024)

As recently as March 2024, Accenture executives participated alongside Huawei at the TM Forum Autonomous Network Global Summit in Barcelona, jointly launching an industry initiative toward L4 autonomous networks.

Participants included:

Huawei senior ICT leadership

China Mobile (a state-owned telecom operator identified as Chinese military company by the US Department of Defense)

Accenture managing directors

The initiative focused on:

AI-driven network automation

Digital twins

Intent-driven closed-loop systems

Large-model (generative AI) integration

Key observation:

Despite geopolitical decoupling rhetoric, Accenture and Huawei remain present in the same technical governance and standards-setting forums, with no evidence of mutual disengagement.

https://www.huawei.com/cn/news/2024/3/mwc-level4-autonomous-networks-summit

Pattern Summary

Across a decade, Accenture–Huawei cooperation demonstrates a consistent pattern:

2014–2018: Strategic alliance formation and ecosystem integration

2019–2020: Deep technical cooperation using Huawei Cloud and smart infrastructure frameworks, post–Entity List

2024: Continued joint participation in advanced network and AI-driven infrastructure initiatives

This is not merely historical exposure. It reflects ongoing technical proximity and reputational interoperability.

Why This Matters

The core issue is not whether Accenture violated any specific law.

The issue is whether Western regulators, investors, and government clients fully understand the structural reality:

Accenture China operates inside a Party–state governance system

Its China leadership participates in United Front–aligned organizations

It collaborates with companies designated by the U.S. government as national security concerns

Its global brand and access to Western technology ecosystems can function as a reputational and technical bridge for entities that otherwise face restrictions

In this context, Accenture’s Huawei collaboration is not an isolated business choice, but part of a systemic entanglement risk.

Expanded Risk Network Beyond Huawei

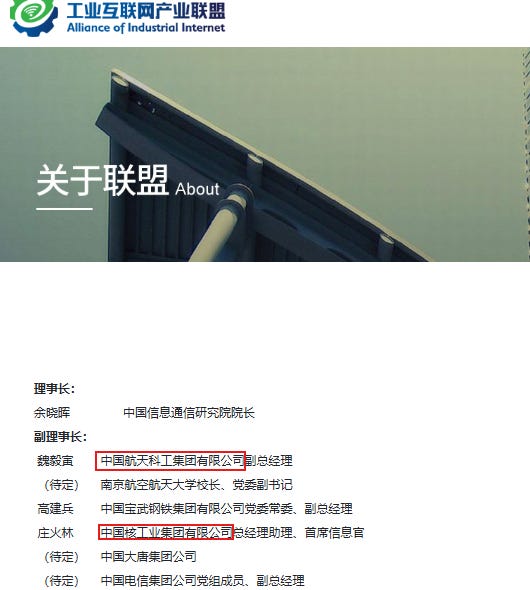

Beyond its direct cooperation with Huawei, Accenture and Huawei also appear alongside multiple PRC military-linked entities and U.S. sanctions-listed institutions within the same state-guided industrial organization: the Alliance of Industrial Internet (工业互联网产业联盟). This alliance operates under the business guidance of China’s Ministry of Industry and Information Technology (MIIT) and is administratively hosted by the China Academy of Information and Communications Technology (CAICT), a core policy think tank directly affiliated with MIIT.

The alliance’s leadership structure is dominated by executives from central state-owned defense conglomerates and strategic technology firms, including China Aerospace Science and Industry Corporation (CASIC), China National Nuclear Corporation (CNNC), China Electronics Technology Group Corporation (CETC), China State Shipbuilding Corporation affiliates, China Mobile, Huawei, and Haier. Notably, individuals affiliated with Beijing Institute of Technology (BIT)—a university long identified by the U.S. government as deeply embedded in China’s military-industrial and weapons research ecosystem—also hold formal roles within the same organizational framework

Accenture (China) is not merely a peripheral participant. A senior executive of Accenture (China) serves as a vice chair within the alliance’s Supply Chain Special Working Group, alongside Huawei’s global cloud and supply chain leadership and Haier’s supply chain industrial executive. This working group explicitly focuses on building “digital supply chain standards and models” through industrial internet technologies, a domain that has clear dual-use implications and is directly relevant to military-civil fusion objectives promoted by the CCP

According to the Alliance’s charter, working groups are not independent or bottom-up technical forums but are structurally subordinate to the alliance’s leadership bodies. Membership admission is centrally reviewed by the Secretariat and approved by the Standing Council, while the Board of Directors—and, during recess periods, the Standing Council—retains explicit authority to decide the establishment of all working groups. Importantly, director-level members may participate in working groups and propose group leaders, while chair and vice-chair units are granted priority rights to nominate or recommend working group heads and to undertake alliance-coordinated projects. Members are also bound by strict confidentiality obligations regarding internal discussions and unfinished outputs. In practice, this governance design ensures that working groups operate under top-down oversight, align with leadership priorities, and function as execution arms of the alliance’s strategic agenda rather than autonomous industry collaborations.

Under Article 24 of the Alliance charter, the Standing Council—composed of the Chair, Vice-Chairs, Secretary-General, and Deputy Secretary-General—exercises top-level control over the alliance’s operations, including oversight of all working groups. The current council membership highlights the nexus of state-directed, military-industrial, and technology leadership: Chair Yu Xiaohui (Director, China Academy of Information and Communications Technology), Vice-Chairs Wei Yiyin (Deputy General Manager, China Aerospace Science & Industry Corporation), Zhuang Huolin (Assistant GM & CIO, China National Nuclear Corporation), Zhang Dongchen (Deputy Party Secretary & GM, China Electronics Corporation), Wang Jianzhong (GM, China Mobile Shanghai Industrial Research Institute), Chen Lucheng (Chair & GM, Haier Kaos IoT), Kang Ning (President, Huawei Cloud Global Ecosystem), Pang Songtao (VP, Inspur Group), and Li Kai (Assistant GM, China State Shipbuilding Corporation – Huangpu).

The alliance’s Supply Chain Special Working Group operates directly under this council, with co-leadership including Huawei’s CIO Fan Meihua, Haier’s Supply Chain GM Chen Wei, and Vice-Chairs including Accenture China’s Managing Director Pan Zheng, along with academic representatives from Beijing Institute of Technology, Beijing Foreign Studies University, and University of Chinese Academy of Sciences. The group’s mandate is to advance industrial internet-driven, cross-sector digital supply chain platforms, codify standards and best practices, and accelerate the digital transformation of supply chains across industries. By design, the working group functions as an operational arm of the Standing Council, ensuring alignment with government, military, and strategic technology priorities rather than independent industry-driven collaboration.

The coexistence of Accenture, Huawei, PRC defense SOEs, and sanctioned military-linked academic institutions within a single, MIIT-supervised alliance underscores a structural risk: U.S. and allied firms may be contributing expertise, methodologies, or legitimacy to an ecosystem designed to integrate commercial digital infrastructure with state and military priorities. This risk exists independently of any single bilateral partnership and persists even if individual cooperation agreements are publicly downplayed or rebranded.

In the 7th China Hospital Presidents’ Annual Conference, held in November 2013, Accenture’s Asia-Pacific Vice President Brad Cable was on the same stage as senior PLA-affiliated hospital leader Li Jingbo, the president of the Third Military Medical University Southwest Hospital of the People’s Liberation Army(PLA) of Chinese Communist Party, and high-ranking Chinese health officials. This is a classic example of foreign corporate executives participating in forums alongside PLA-linked personnel, giving them access to sensitive operational insights, healthcare data flows, and possibly strategic information under the guise of “industry dialogue” or “big data discussion.”

Even though the topic appears benign—hospital management, healthcare reform, or big data analytics—the fact that a foreign corporate VP can share panels with military medical institutions in China illustrates:

Direct exposure to military-affiliated expertise and networks: The Third Military Medical University is a PLA institution; its leaders are involved in military health R&D.

Access to policy insights: Discussions included national-level healthcare reforms, personnel allocation, and big-data utilization in hospitals, which have broader national security implications.

Legitimacy & normalization: By appearing alongside PLA-linked officials in public conferences, foreign companies like Accenture signal compliance and alignment with Chinese policy, smoothing future collaborations—even in sensitive areas.

This is exactly why any collaboration with such events cannot be dismissed as routine corporate networking; it constitutes a potential conduit for knowledge sharing between a foreign consulting firm and military-linked institutions, raising national security concerns for countries like the U.S.

Li Jingbo, born January 1958, was the President of the Third Military Medical University Southwest Hospital, a key PLA medical institution. He held the rank of PLA Senior Colonel (大校), was a Chief Physician and Professor, and served as a doctoral supervisor. Li also concurrently served as Vice Chair of the PLA’s National Military Health Economics Management Committee.

He has decades of experience in hospital administration and research-focused management, with a particular emphasis on digitalization, medical quality control, and innovation in hospital operations. Since assuming leadership of Southwest Hospital in December 2006, Li has promoted military-civil integration in hospital management, focusing on strategic planning, scientific management, research-oriented operations, and an “eco-systemic” approach to development. He has implemented frameworks emphasizing large-scale disciplines, talent, quality, and management systems while optimizing hospital workflows and resource utilization.

Li has received high-level recognition from the PLA General Logistics Department for “Advanced Education Work,” underlining his influential role within military healthcare administration. His participation on the same panels as foreign executives—such as Accenture’s Asia-Pacific VP—demonstrates direct interaction between a foreign corporate leader and a senior PLA officer, raising potential concerns about access to sensitive operational, organizational, and digital information in China’s military-medical sector.

6. The Core Risk: Structural, Not Incidental

The key issue is whether Western regulators, investors, and clients fully understand the structural reality:

Accenture China operates inside a party-state governance system

Its senior executives participate in United Front–aligned capital organizations

Its China entities collaborate with firms designated by the U.S. government as national security concerns

Its global brand enables access to Western technology ecosystems that Chinese firms often cannot access directly

This creates systemic risks in areas such as:

Export controls

Data governance

M&A due diligence

Conflicts of fiduciary duty

National security reviews (e.g., CFIUS)

7. Why Disclosure Standards Matter

None of the above is hidden — but neither is it clearly surfaced in investor-facing risk discussions.

Financial materiality thresholds were not designed to capture:

Political embeddedness

Party-state influence

United Front participation

Strategic technology transfer pathways

Yet these factors increasingly drive regulatory outcomes.

8. Conclusion: Questions That Deserve Answers

Accenture is not unique — but it is unusually well-positioned at the intersection of:

Western capital markets

Global technology ecosystems

China’s party-state industrial strategy

That position warrants far more scrutiny than it currently receives.

The facts are public.

The implications have not yet been fully debated.

In the event of heightened scrutiny, Accenture could plausibly respond through leadership reshuffles within its China entities, emphasizing localization, internal governance optimization, or “management succession planning.” Such changes—especially if framed as routine or market-driven—may be presented as evidence of risk mitigation.

However, personnel changes alone do not dismantle underlying institutional linkages.

If party-affiliated internal organizations remain embedded within corporate operations, if strategic partnerships with entities tied to China’s military-civil fusion ecosystem continue, and if revenue-generating collaborations with sanctioned or high-risk firms are merely re-routed through intermediary structures, then the risk profile remains fundamentally unchanged—only less visible.

In this context, reputational cleansing should not be mistaken for strategic disengagement.

True de-risking would require:

verifiable separation from high-risk technology ecosystems,

transparency regarding political and organizational embeddedness,

and enforceable internal controls that go beyond formal compliance narratives.

Absent these measures, external observers should remain cautious:

what looks like reform may, in practice, be continuity under a different name.

Accenture’s “China problem” isn’t just a local operational issue. Events like the 2024 Spain forum, where a non-Chinese Accenture executive appeared alongside Huawei and China Mobile, highlight that the risk is embedded at the global corporate level, not merely in the Chinese subsidiary.

This suggests several things:

Systemic governance – Accenture’s global policies allow high-level executives to participate in events with entities tied to PLA or Chinese state tech, which could expose proprietary consulting methods or digital strategies.

Risk isn’t localizable – Even if the China subsidiary is restructured, or local leadership replaced with party-approved personnel, the connections, institutional knowledge, and decision-making authority remain with foreign executives.

Headquarters accountability – It points to potential global compliance and oversight gaps, meaning U.S. or EU regulators could flag Accenture at the corporate level, not just the subsidiary level, for interactions with sensitive Chinese entities.

In short: swapping Chinese leadership is cosmetic. The structural, global-level interactions with PLA-linked and state-owned enterprises are the real risk factor.

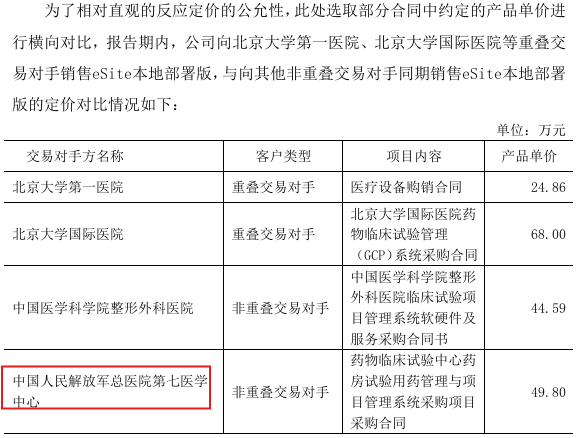

On November 8, 2025, Taimei Medical Technology Co., Ltd. signed a strategic cooperation memorandum of understanding with Accenture (China) Ltd. during the China International Import Expo. The collaboration aims to explore digital transformation in China’s life sciences sector, focusing on clinical research, drug development, pharmacovigilance, and market access. Executives attending the signing included Taimei Medical CEO Zhao Lu, senior leaders from Taimei, and Accenture Greater China Life Sciences Managing Director Yang Jigang, as well as Accenture Greater China Intelligent Operations President Yue Bin.

Taimei Medical actively positions itself as a digital platform for the life sciences industry, linking hospitals, pharmaceutical companies, service providers, regulators, and patients through its proprietary TrialOS platform, utilizing AI, big data, and mobile technologies. The platform enables streamlined data flow, standardized processes, and industry-wide coordination, potentially influencing clinical trials, drug approval pathways, and patient data management.

Crucially, Taimei Medical has direct ties to the Chinese military: a research collaboration supported by the PLA General Hospital under Professor Xu Jianming, a senior PLA physician and member of the PLA Military Health Science and Technology Committee, led to clinical studies presented at the European Society for Medical Oncology (ESMO). Professor Xu holds multiple PLA leadership roles in oncology and pharmacology, and has received top military medical awards.

Furthermore, Taimei has sold its eSite clinical trial management system to PLA General Hospital units, demonstrating operational integration with the Chinese military healthcare system

The pattern is clear: from 2013 to 2025, Accenture has maintained continuous, overlapping engagement with PLA-linked entities, without any clear operational or corporate separation. Whether it’s through high-level executives attending PLA-connected events, digital healthcare collaborations with PLA hospitals, or industry platforms like Taimei Medical that interface directly with military-backed research, there is no evidence that Accenture ever cut ties, blocked access, or imposed internal sanctions against PLA involvement.

No comments:

Post a Comment