According to Keystone Symposia & Digitell, Inc and CONGRESSMAN MO BROOKS REPORTS ON INTERVIEW WITH DR. LI-MENG YAN REGARDING COVID-19 & COMMUNIST CHINA'S BIO-WEAPONS PROGRAM, Dr. Li-Meng Yan received her PhD from Southern Medical University,formerly known as the First Military Medical University of the Chinese People's Liberation Army, and defected to the United States of America from the People's Republic of China. So Dr Li-Meng Yan is a scientist with military university training background who defected to the USA and her opinions must be taken seriously.

According to The Constitution of Southern Medical University, Southern Medical University was formerly known as the First Military Medical University of the Chinese People's Liberation Army. In August 2004, in accordance with the orders of the State Council of the People's Republic of China and the Central Military Commission, it was handed over to the Guangdong Provincial People's Government as a whole and changed its name to Southern Medical University.

Article 56 Alumni Association of Southern Medical University is a non-profit social organization voluntarily formed by alumni registered and established by the school in accordance with the law. Alumni refer to those in Southern Medical University (including the former First Military Medical University, the former Guangzhou Military Region Medical College) ,faculty and students who have worked, studied, and advanced in colleges and universities and their predecessors, as well as part-time professors, visiting professors, honorary professors, and honorary doctors hired by the school.

Article 65 of the Constitution of Southern Medical University:...the school emblem...an olive branch is surrounded by an olive branch on both sides of the shield, implying that the school once belonged to the army;...

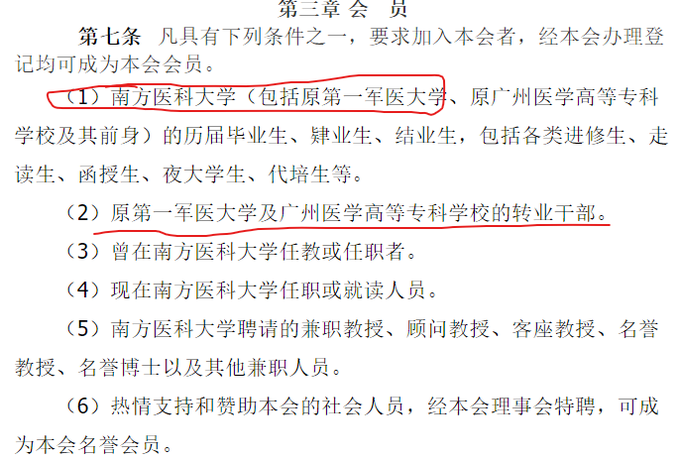

The constitution of the Alumni Association of Southern Medical University written in Chinese:

Article 7 Anyone who has one of the following conditions could be a member of this association.

(1) Graduates of Southern Medical University (including the former First Military Medical University, the former Guangzhou Medical College and its predecessor), including various advanced students, day students, correspondence students, evening students, Dai Peisheng, etc.

(2) Transferred cadres from the former First Military Medical University and Guangzhou Medical College.

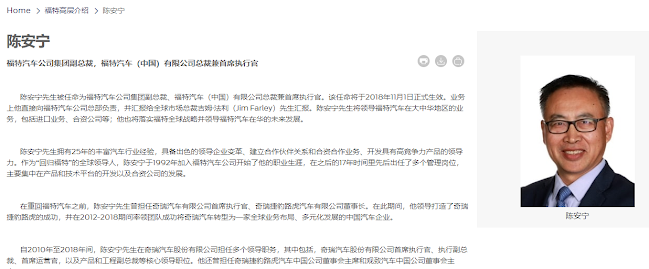

According to the constitution of the Alumni Association of Southern Medical University-NA written in Chinese, anyone in North America... once in Southern Medical University (.. .Predecessor colleges, such as the Chinese People's Liberation Army Military Medical College, the Chinese People's Liberation Army First Military Medical University)... can join the association.Those who participated in the 70th Celebration of Southern Medical University included Shuang-Ning Su (Chief Designer of China's Manned Space Engineering Astronaut System) and Jia-Ke Chai (First Class Meritorious Service of the Central Military Commission). Shenghe Huang , president of the Alumni Association of Southern Medical University-NA, is an honorary professor at the University of Southern California, etc.